Quick Service Industry: Exploring Brand Health and Advertising Perceptions

Case Study

Published Q3 2024

Quick-service restaurants are so well-known and ubiquitous in the United States that it might be easy to assume that brands within the space are relatively similar. However, as we uncovered in this study, there are dramatic differences in consumer engagement with and perceptions of brands in this industry.

Overview

Langston collected sample for this study in June 2024, seeking to determine how quick-service brands perform within key funnel metrics such as awareness, familiarity, consideration, and purchase rates. In addition, Langston sought to understand advertising metrics such as ad recall, channel usage, and ad perception as well as how advertising effects overall brand image.

Insights

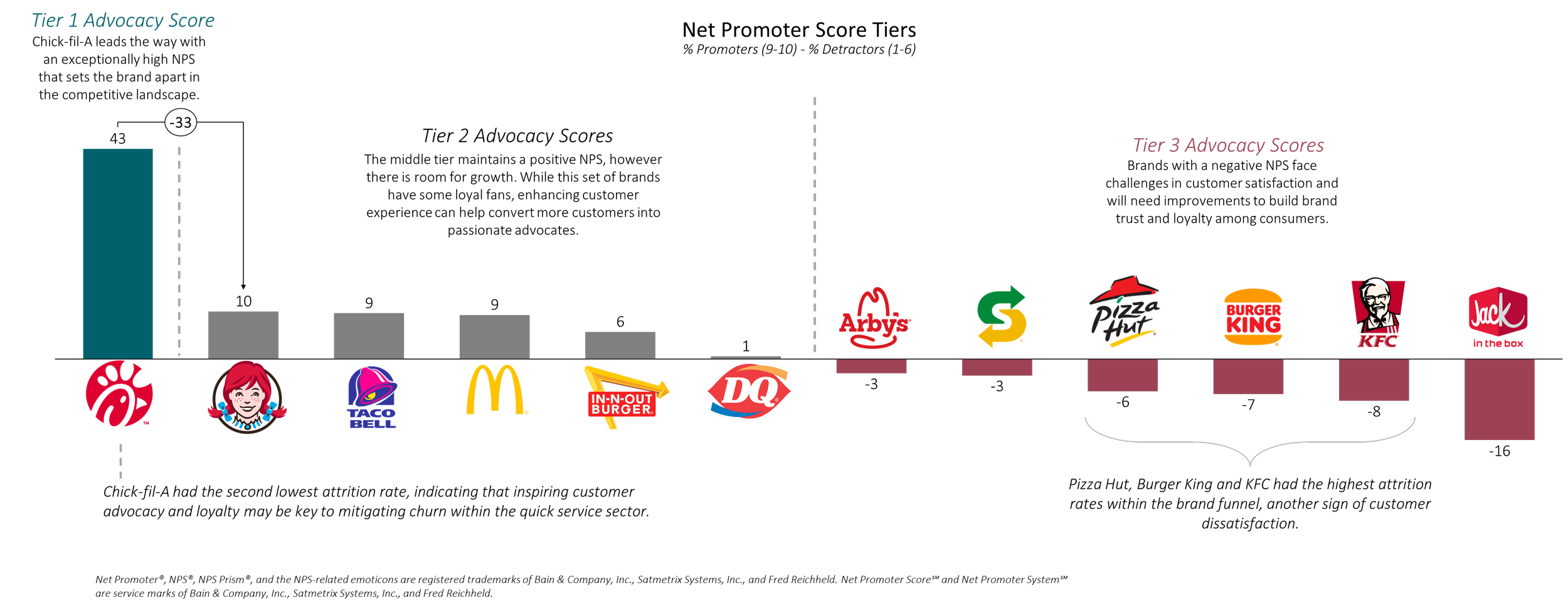

Insight 1: While other Quick Service brands have customers, Chick-fil-A has fans.

Chick-fil-A stands out as the most loved in the space, fostering strong favoritism and advocacy among its loyal fan base. This is evidenced by its exceptionally high Net Promoter Score, which places it in a league of its own within the Quick Service Space. We found that nearly half of those familiar with Chick-fil-A said they were “extremely likely” to recommend the brand, meaning they gave it a top box score. In fact, higher percentage of brand familiar consumers gave Chick-fil-A a 10 than 9s and 10s combined for any other brand.

Furthermore, the brand accomplishes this while having the fewest physical locations. The brand is well-positioned with high consumer favoritism relative to its size and reach, likely due to resonant advertising and high-quality products. Additionally, given its smaller physical footprint, the idea of limited availability—driven in part by being closed one day a week-- may enhance the perception that visiting the brand is a special treat or occasion for customers.

Insight 2: McDonald’s is firmly established as the leader in the Quick Service Industry.

The brand effectively dominates every stage of the brand funnel, showcasing its strong presence and influence in the market. McDonald’s performs particularly well on past week purchase rates, with over half of qualifying consumers reporting that they have bought from the brand in the past week. Given the brand’s ubiquitous physical presence and morning-to-night menu options, this may be unsurprising; however, just how far the brand outpaces competitors is worth noting.

However, when examining metrics related to consumer advocacy, such as the Net Promoter Score, McDonald’s falls lower than expected given its strong funnel metrics. This suggests that while it holds a clear position as the best-known and most-visited brand, it does not evoke the same level of passionate loyalty among consumers as select competitors, like Chick-fil-A.

Insight 3: The Quick Service sector is facing retention issues, with many brands having more past purchasers than current considerers.

When a brand’s conversion rate exceeds 100%, as it does for all brands except for In-and-Out, it indicates that more individuals have purchased from the brand than those who express a willingness to consider visiting in the future.

It's important to note that this analysis is based on self-reported survey research, which can come with inherent limitations, such that consumers stating one thing while behaving differently in practice. Individuals may view themselves more positively and express a desire to reduce their fast-food consumption, thus saying they would not consider a brand, yet end up purchasing it regardless.

It is also noteworthy that in general, brands with positive Net Promoter Scores, such as Chick-fil-A, Wendy’s, and Taco Bell tend to have lower attrition rates. This may suggest that creating a positive customer experience, that consumers are willing to recommend, could be pivotal for addressing industry-wide customer loyalty and retention challenges.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.

More insights, more data. Download this study to learn more.

In order to conduct unbiased and objective research, this study was privately funded by The Langston Co. We did not receive endorsement or financial support of any kind from any third party.

Thanks for taking time to read our research. With questions, comments, or suggestions about this study, please contact us at contact@thelangstonco.com.